Indonesia is a country rich in solar energy potential, thanks to its location on the equator. It stands out in Southeast Asia with an estimated capacity to produce up to 7,715 GW of solar power – a potential that far exceeds many of its neighbors. To harness this potential, the Indonesian government has set ambitious goals, aiming to boost the country’s solar energy capacity to 6.5 GW by 2025 and to 17.6 GW by 2035.

These efforts are part of a broader strategy to transform Indonesia’s energy sector and tap into regional markets for renewable energy. This strategy includes seizing opportunities like Singapore’s initiative to import renewable energy, which could drive growth in Indonesia’s solar manufacturing sector. Indonesia’s geographic advantage and strategic initiatives position it to potentially lead the region in solar energy production.

‘Solar energy potential’ refers to the capacity of a specific area or region to produce electricity using solar power, based on its geographic and environmental conditions. This potential is often measured in terms of solar irradiance, which is the amount of solar radiation, or sunlight, that reaches the ground in a given area. The greater the solar irradiance, the more energy can be produced from solar panels installed in that location.

Indonesia is considered ‘rich’ in solar energy potential primarily due to its geographical location near the equator. This location ensures that Indonesia receives a high level of solar irradiance throughout the year. Equatorial regions benefit from consistent daylight hours and high sun angles, which maximize the solar energy that solar panels can capture and convert into electricity.

Other factors that contribute to Indonesia’s high solar energy potential are its vast landscape and diverse topography, which includes numerous islands and sea areas which are suitable for both traditional and innovative solar installations (for example, floating solar panels).

A closer look at Indonesia’s solar PV potential

The Ministry of Energy and Mineral Resources (MEMR) and the Institute of Essential Services Reform (IESR) have estimated the country’s potential at 3,294 GW and 7,715 GW, respectively. This figure comes from the country’s average daily global horizontal irradiation of 4.8 kWh/m2, which even surpasses that of many countries known for their solar production, such as Germany and Japan.

As a result, the Indonesian government has set ambitious goals for expanding its solar power infrastructure. According to Presidential Regulation No.22/2017, which outlines the General Plan for National Energy (RUEN), Indonesia aims to increase its installed solar power capacity to 6.5 GW by 2025, and 17.6 GW by 2035.

The government’s intention for achieving this is not only by focusing on building capacity, but also through incorporating diverse applications of solar technology, including floating solar PV systems, rooftop installations, and utility-scale solar farms.

How does Indonesia’s solar PV development compare to similar regions?

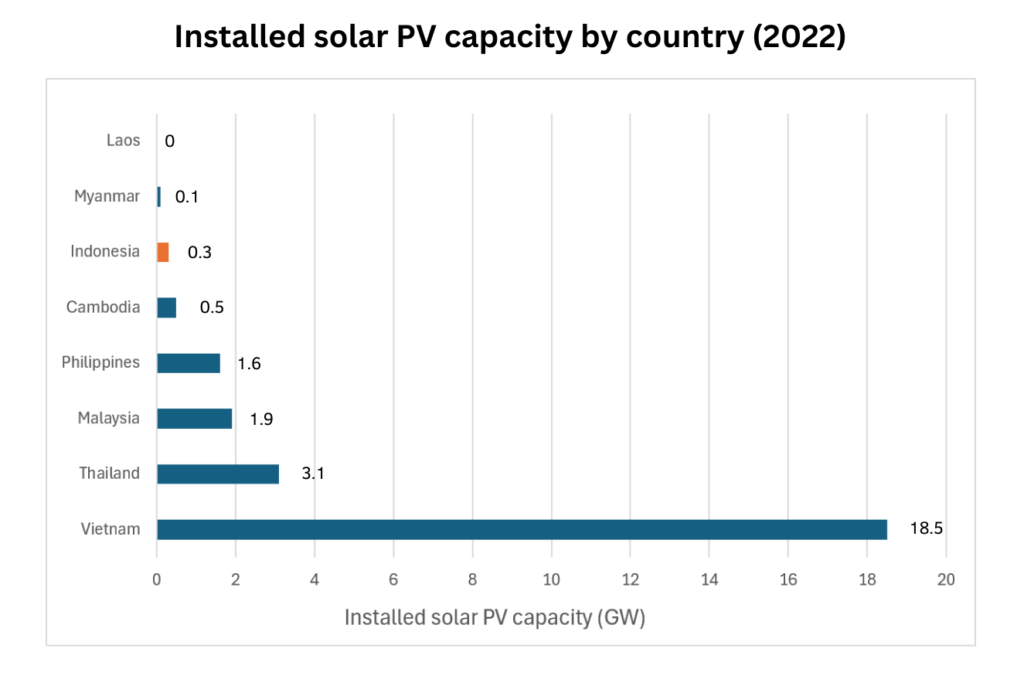

So far, Indonesia’s solar PV development has been more gradual compared to neighbouring countries in Southeast Asia, with the country having only 0.3 GW of installed solar capacity as of 2022. This is in stark contrast to regional leaders such as Thailand and Vietnam, which have significantly higher capacities of 3.1 GW and 18.5 GW respectively, in part due to these countries’ focus on expanding their solar potential and energy infrastructure.

The entire Southeast Asian region is expected to see substantial growth in solar PV in the coming years – specifically, it is projected to grow from around 25 GW in 2022 to over 100 GW by 2030 (in a net-zero scenario). This growth is expected to be driven by falling costs of solar technologies in addition to a collective regional commitment to reducing carbon emissions. Indonesia, with its abundant solar potential, is particularly expected to benefit from this growth. The country would be able to serve as a key exporter of electricity to neighbouring countries.

One such country that could benefit from importing solar-generated electricity from Indonesia is Singapore – Singapore’s Energy Market Authority (EMA) has detailed their plans to import up to 4 GW of low-carbon electricity by 2035 to enhance its energy security, and to integrate more renewable energy into its grid. This policy is but one example of an opportunity for Indonesia to scale up its solar PV manufacturing and become a key energy exporter within the region.

What challenges and opportunities does Indonesia’s solar growth face?

With every opportunity comes its challenges – and Indonesia’s solar expansion is no exception, with Indonesia facing a number of hurdles in expanding its solar energy sector quickly. One major issue is the country’s geography. With Indonesia comprised of over 17,000 islands, setting up a unified energy system is both complex and expensive.

Another challenge is competition from cheaper, conventional energy sources like coal and natural gas, which are abundant in places like Java (one of Indonesia’s major islands). High import taxes on solar equipment also make solar energy more expensive than in neighboring countries, which slows down its adoption further.

Despite these challenges, there are significant opportunities that could boost Indonesia’s solar industry. As discussed in the section above, Singapore’s plan to import more renewable energy could be a big opportunity for Indonesia. Singapore’s EMA (Energy Market Authority) wants to import up to 4 gigawatts of clean electricity by 2035. Indonesia could therefore become a key supplier.

This demand from Singapore could drive growth in Indonesia’s solar sector, encouraging more investments and helping to build larger manufacturing facilities. By tapping into this external market, Indonesia could accelerate its solar energy production and contribute to regional energy needs, supporting both economic growth and environmental sustainability.

What strategies are Indonesia using for growing their solar sector?

Indonesia is currently advancing its solar photovoltaic (PV) sector through well-planned government strategies and regulatory frameworks. For example, Indonesia’s Electricity Business Plan (RUPTL) sets a target for solar PV to contribute around 5 GW by 2030. To support this, the government has implemented a local content requirement, which mandates that a significant portion of solar components must be produced domestically.

To attract more investment and enhance competitiveness, the Indonesian government offers various incentives for local manufacturing. These include tax breaks and financial aids which lower the costs for companies setting up production facilities in Indonesia. This approach aims to boost domestic manufacturing capabilities, create jobs, and reduce dependency on imported solar products.

Scaling production to meet domestic needs and tapping into export markets is crucial for growth. For Indonesia to be cost-competitive, particularly against major producers like China, production needs to ramp up significantly. By producing more, the country can reduce costs through economies of scale. The government’s plan includes potentially reaching a production level of around 3 to 7 GW per year. This scale is essential not just to meet local demands but also to fulfill export potentials, especially to markets like Singapore, which is actively looking to import renewable energy.

Another key strategy that Indonesia is using is attracting foreign Original Equipment Manufacturer (OEM) investments. By providing a conducive environment for these manufacturers, Indonesia could accelerate its solar manufacturing capacity. Neighboring countries like Vietnam have successfully attracted Chinese OEMs by offering tax incentives and removing local content obligations – a strategy that Indonesia may also consider to enhance its attractiveness to foreign investors.

What does Indonesia's solar manufacturing landscape currently look like?

In the context of Indonesia’s solar PV industry, “local content requirements” refer to regulations which mandate that a certain percentage of the components used in solar power projects should be sourced domestically. These rules are designed to promote the development of the local manufacturing sector, ensuring that a significant portion of the equipment and materials used in solar installations are produced within the country.

The primary aim of this policy is to stimulate job creation, foster technological skills amongst its citizens, and reduce dependency on imported goods. The ultimate goal is to build up the local industry, enabling it to compete more effectively in the global market.

Indonesia’s local content requirements have significantly shaped its solar photovoltaic (PV) manufacturing landscape. Their current regulation, known as the Mandatory Local Content Requirement (TKDN), demands that a substantial percentage of solar components be sourced domestically. This requirement started at 40% in 2022, and is planned to increase to up to 90% by 2025. While the policy aims to stimulate domestic manufacturing and reduce reliance on imports, it does pose challenges in attracting foreign investment.

Foreign Original Equipment Manufacturers (OEMs) often find these high local content requirements restrictive, as they limit the ability to integrate more cost-effective and technologically advanced components from global markets. This can make local production less competitive on a global scale, especially against regions with fewer restrictions. For instance, Vietnam has successfully attracted foreign investments by opting not to impose local content requirements, allowing manufacturers more freedom in sourcing components.

Currently, Indonesia’s solar manufacturing landscape is relatively nascent, with significant potential for growth. The government is considering adjustments to the TKDN to make the market more appealing to foreign investors. These potential adjustments may include lowering the required percentage of local content in the short term to attract investments, and then gradually increasing it as domestic manufacturing capabilities improve.

Strategic changes like these could enhance Indonesia’s competitiveness in the solar industry by balancing the need for local industry growth with the attraction of global solar manufacturers. This approach would provide the necessary flexibility for foreign companies to operate efficiently, while still fostering the development of local industries.

What does the future look like for Indonesia's solar growth?

All-in-all, Indonesia’s solar PV market still holds significant promise, mostly fueled by the nation’s rich solar resources and the country’s ambitious strategic initiatives. Current trends suggest a positive trajectory in solar growth, especially with the government’s ambitious goals to boost solar capacity to 17.6 GW by 2035. Regional dynamics, like Singapore’s push for renewable energy imports, further encourage Indonesia’s potential as a key player in Southeast Asia’s solar market.

However, in order to solidify this growth, there will likely need to be some policy adjustments – almost all of which concern international collaboration and investment. Firstly, Indonesia might consider revising local content requirements to strike a balance between nurturing domestic industries and attracting foreign investment. While current mandates aim for up to 90% local content by 2025, a more gradual increase could entice foreign investors seeking entry into the Indonesian market without facing steep initial costs. This could give them a significant boost in accelerating sector development.

Building upon this, another solution is through enhancing investment incentives. Offering tax breaks, grants, or low-interest financing to solar manufacturers can make Indonesia more appealing to international players. This financial support would help to cover the high upfront costs which are associated with setting up solar manufacturing facilities, thus making investments more feasible.

In any case, Indonesia’s solar PV market will surely grow by some degree over the coming decade – but exactly how much growth we see will depend heavily on the nature of their policies.

For more reading on solar power in Indonesia, visit:

Here are some other Solar Trek articles you may be interested in: